Concentration Wins in Constraint Regimes (Diversification Doesn’t)

2025 proved that being broadly right isn’t the same as being effectively positioned.

Welcome to Fearless Investor — calm thinking for chaotic markets.

Each week, we break down macro constraints, capital flows, and portfolio structure so serious investors can stay oriented while others react.

Subscribe so you don’t miss the next deep dive.

Concentration Wins in Constraint Regimes

(Why 2025 punished diversification and rewarded alignment)

For most of the last decade, diversification felt like discipline.

Cheap capital, low volatility, and abundant liquidity meant that spreading exposure across many ideas rarely carried a penalty. Even mediocre positioning was forgiven as long as markets continued to rise.

2025 was different.

Not because volatility exploded — but because constraints finally mattered again.

Energy wasn’t a theme.

Liquidity wasn’t evenly distributed.

AI wasn’t limited by imagination, but by power, infrastructure, and balance sheets.

In that environment, being broadly right stopped being enough.

From a capital allocator’s perspective, the defining feature of 2025 wasn’t dispersion across assets — it was dispersion across outcomes. A small number of aligned positions did the overwhelming majority of the work. Everything else ranged from marginal to distracting.

This wasn’t a failure of diversification as a principle.

It was a failure of diversification without hierarchy.

Markets don’t react to headlines — they react to constraints. And when constraints bind, capital doesn’t reward optionality evenly. It flows toward the assets, structures, and balance sheets most directly exposed to the bottleneck.

In 2025, portfolios that tried to “own a little of everything” often diluted their best ideas with exposures that had no meaningful path to upside under real-world limits. Meanwhile, portfolios that expressed conviction — carefully, deliberately, and with size — captured the asymmetry.

This matters less for narratives and more for balance sheets.

Because the real challenge isn’t identifying the right macro view.

It’s deciding how much capital that view deserves — and what gets crowded out as a result.

Why This Becomes Harder in 2026

The lesson from 2025 is not to trade more.

It’s to manage success correctly.

As gains compound, the temptation is to protect them with complexity: more positions, more hedges, more “diversification” layered on top. But in constraint-driven regimes, complexity often adds friction faster than it adds resilience.

The edge going into 2026 is still macro.

The risk is behavioral.

And that brings us to the part most investors avoid: looking honestly at what drove returns — and what didn’t.

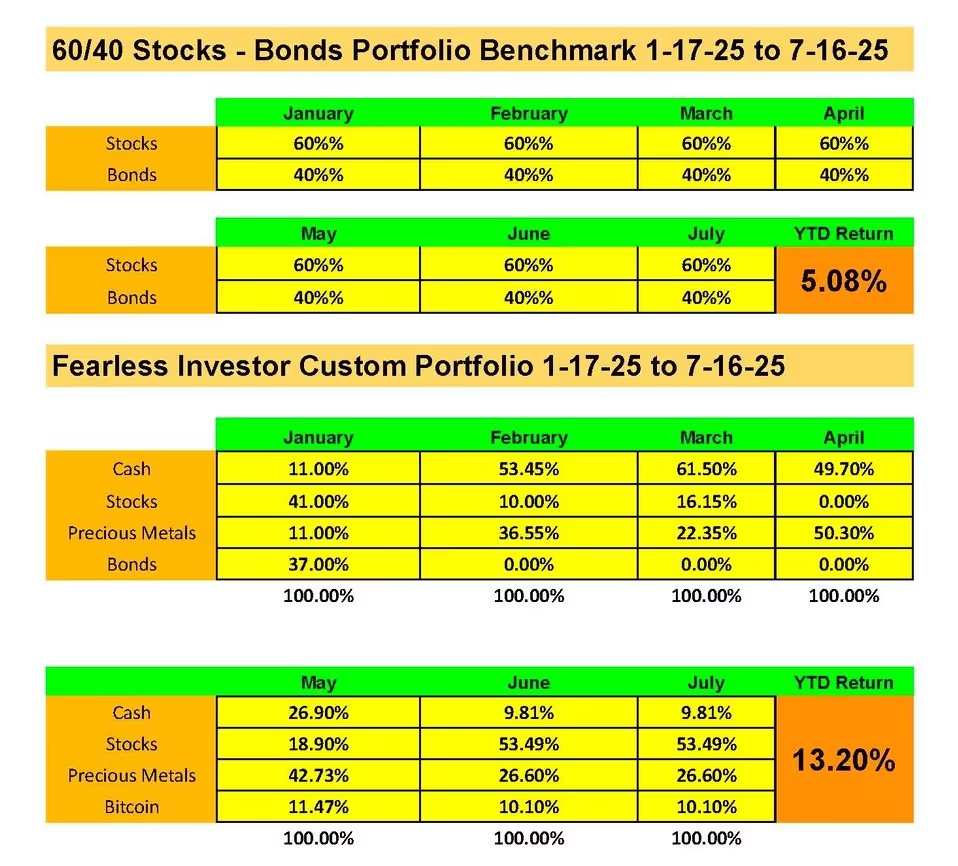

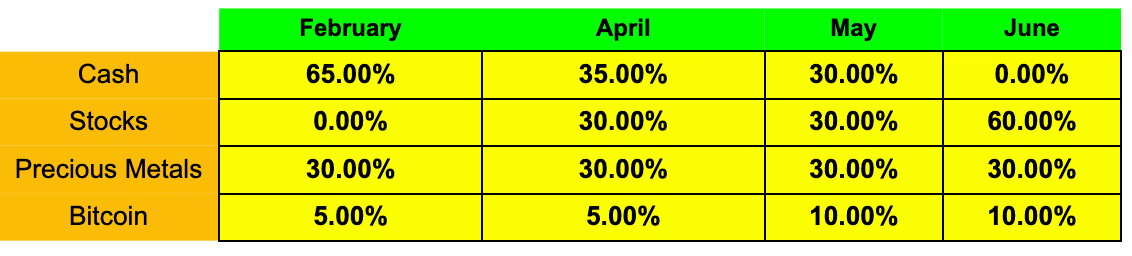

Before looking forward, it’s worth being explicit about what 2025 actually produced at the portfolio level — not just in narrative terms, but in structure.

That’s where the real work begins.

Want to Go Deeper?

If you’re an investor exploring energy deals or private opportunities, you can book a call with Dakota Ridge Capital here:

👉 https://dakotaridgecapital.com/contact

And if you want weekly insight, deeper analysis, and access to a serious investor community, you can learn more about the Fearless Investor Community here:

👉 https://dakotaridgecapital.com/community

No hype.

No panic.

No guessing.

Just smart decisions, made consistently.

Continue reading for the member-only analysis below.

In the premium section, we go beyond theory and show how this framework is implemented.

Fearless Investor Premium Members get:

- A full walk-through of how we apply the 2026 Market Constraint Checklist to portfolio construction

- A side-by-side comparison of diversified vs. concentrated outcomes from 2025

- Position-sizing logic used inside real portfolios

- The Constraint Alignment Test: a practical tool to stress-test whether an asset deserves capital

.svg)

.svg)

.svg)

.avif)

.svg)

.svg)

.webp)